Governance

Good governance forms the foundation for solid relations between shareholders, the Board of Directors, executives, employees, customers and other stakeholders, and encourages objectivity, integrity, transparency and responsibility in the management of the Bank. We comply with recognised guidelines on corporate governance and publish an annual governance statement with the Annual & Sustainability Report.

The Board of Directors is elected at the AGM for a one-year term. Seven directors and two alternates are elected.

The Board of Directors is ultimately responsible for the Bank’s activities as provided for by laws, regulations and its Articles of Association. The Board of Directors formulates the Bank’s general strategy and shall ensure that the Bank’s organisation and activities are conducted properly. The Board of Directors also monitors the Bank’s general activities and ensures that control of accounting and financial management is satisfactory.

There are three sub-committees to the Board of Directors: The Audit Committee, the Risk Committee and the Remuneration Committee. Amongst other duties, the committees prepare the Board’s discussion of certain aspects of the Bank's activities and follow up on related matters.

Alternate members of the Board are Sigríður Olgeirsdóttir (since March 2021) and Sigurður Jón Björnsson (since April 2019).

Executive Board

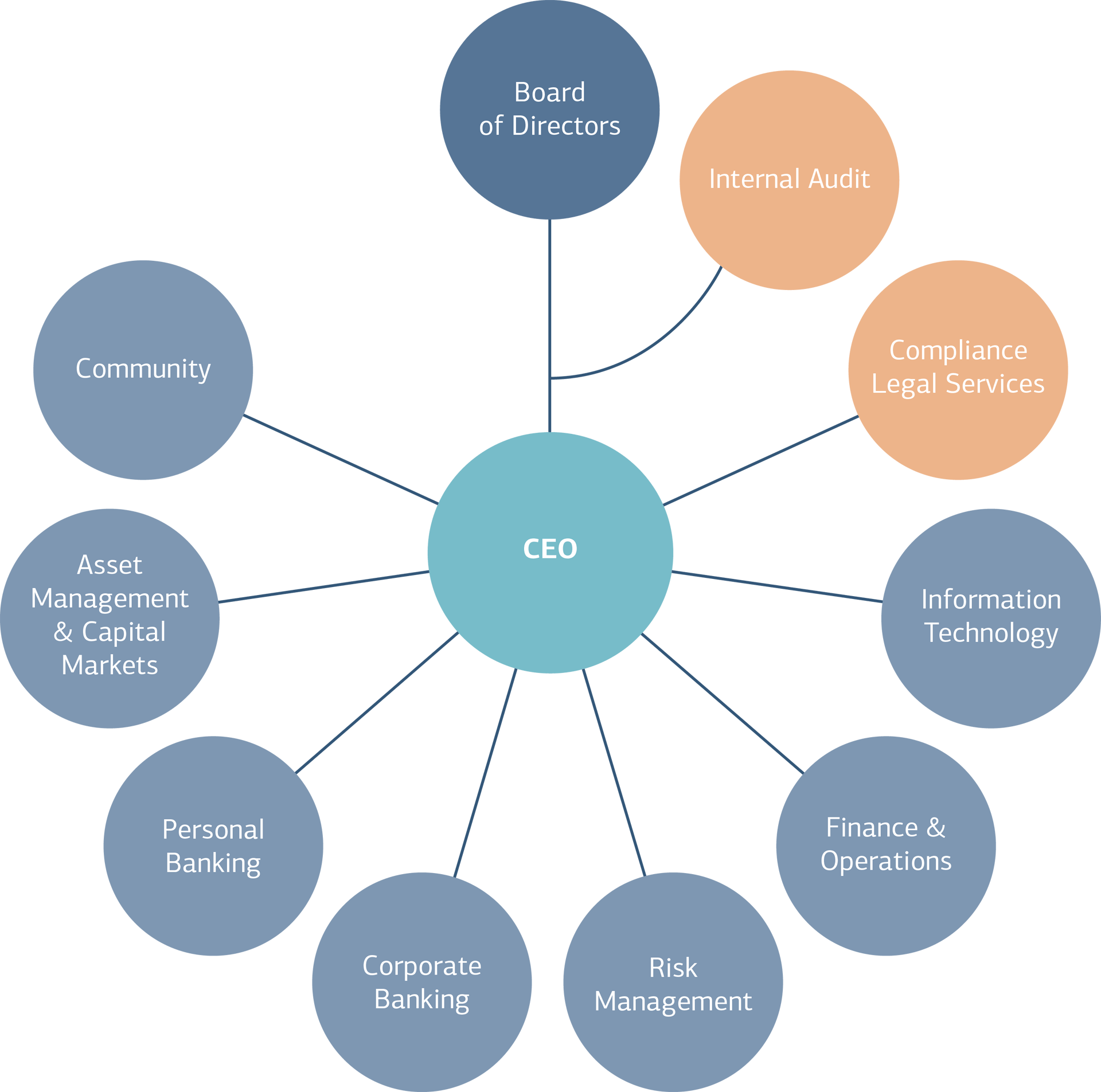

The Executive Board is comprised of the CEO and managing directors of all divisions. The Bank’s CEO is responsible for the Bank’s day-to-day operation and is authorised to take decisions on all matters not entrusted to others by law, the Bank’s Articles of Association or decisions by the Board of Directors. The CEO shall ensure that the Bank's operation complies with law, regulations and the Articles of Associations, and with Board decisions. She shall ensure that the Bank’s accounting complies with law and good business practice and that handling of the Bank’s assets is secure.

Corporate governance statement

Landsbankinn complies with recognised guidelines on corporate governance and publishes an annual statement on its governance practices in a dedicated chapter in its Annual & Sustainability Report.

In August 2021, Stjórnvísi renewed the recognition of Landsbankinn as a model of corporate governance for the period 2020-2021 based on a review undertaken by external advisors of the Bank's governance practices in March 2020

Organisation of Landsbankinn

Landsbankinn’s organisation aims to ensure solid and effective operation while creating opportunities for successful collaboration between departments and groups. Emphasis is placed on ensuring that employees can cooperate on projects across departments and divisions, sharing and enjoying the benefits of diverse expertise. We work as a team, guided by the interests and satisfaction of our customers.

A new division was created in 2021 to reflect the strategic objectives. The division, called Community, became operational in the latter half of the year with the appointment of a new Managing Director. Community unites marketing, communication, sustainability and economic research.

Personal

Personal Banking provides all services to private individuals, including the development of digital solutions. The focus is on providing first-rate service based on utilisation of the Bank’s data and on ensuring that customers can both seek advice and tend to their own business through digital service channels, as well as in the Bank’s branches. Service to small and medium-sized companies in rural Iceland is also handled by Personal Banking, in close collaboration with Corporate Banking.

Corporates

Service and financing for corporates, municipalities and institutions lies with the Corporate Banking division, which is sharpening its focus on digital service, especially for small and medium-sized enterprises, and self-service solutions. Specialised account managers attend to the needs of companies and legal entities in all sectors. Corporate Finance is part of Corporate Banking and provides, among other services, comprehensive and professional advice on the purchase, sale and merger of companies.

Asset Management & Capital Markets

Asset Management & Capital Markets offers high-net worth individuals, companies and investors assistance in finding the right investment and asset-building solutions. The division offers extensive services in the field of asset management, both private banking and professional investors services, in addition to brokerage of securities, currency and derivatives for professional investors and larger customers. Emphasis is placed on personal service, responsible advice and informed decisions.

Finance & Operations

The Bank’s funding, liquidity management and market making all fall under the scope of the Finance & Operations division. Settlement, accounting and business plans are also under Finance & Operations, along with loan administration and transaction services, and operation of the Bank’s property. Project management of construction the Bank’s new headquarters at Austurbakki are under this division.

Information Technology (IT)

The IT division is responsible for the operation, security and development of Landsbankinn’s digital infrastructure. Its activities are based on multidisciplinary teams and collaboration with the Bank’s other units in order to provide and develop first-rate tech solutions and digital services. There is a strong focus on leveraging data on all levels of the Bank’s operation and to ensure that the Bank continues to lead the way in utilising information technology in the domestic financial market.

Risk Management

Risk Management is responsible for the effectiveness of the Group’s risk management framework. The division is also responsible for information disclosure on risk exposure to various departments and units within the Bank, and external regulators.

Community

The Community combines human resources, marketing, education, PR, sustainability and economic research under one hat. The division spearheads the shaping of the Bank’s corporate culture and plays a key role in implementing its strategy which emphasises a new approach to customer relations, including through education, communication and employee training.

Compliance and Legal Services

In addition, two departments operate across the Bank and are directly responsible to the CEO.

Internal Audit

Internal Audit is an independent and autonomous function directly responsible to the Board of Directors. The role of Internal Audit is to improve and protect the Bank’s value with risk-focused and objective verification, consultation and insight. Internal Audit evaluates and improves the effectiveness of risk management, control measures and governance processes through systematic and disciplined practices.

Assets sold in 2021*

Landsbankinn has adopted a clear policy on the sale of assets, intended to promote transparency and credibility in the sale of assets and build confidence in the Bank.

In 2021, Landsbankinn sold 331 appropriated assets, ten real estate properties that previously housed Bank operations, six vehicles, shareholdings in two unlisted companies and 143 pieces of art.** The total sale value of these assets was around ISK 2,712 billion.

During the year, the Bank sold holdings in two companies in connection with the restructuring of financial infrastructure in the financial market and changed emphasis of the Icelandic Banks' Data Centre (RB). The Bank’s share in the joint cash centre, JCC ehf., was sold to RB. Part of the Bank’s holding in RB was also sold to another shareholder in RB. These sales deviated from the main rule of employing an open sale process, with full authorisation by the Board of Directors and in accordance with the Bank’s rules on the sale of assets. The decision is based partly on the interconnected nature of important aspects of the Bank’s activities with those of JCC and RB. These companies play an important role in the Bank’s payment transfer and general commercial banking services. The changes were part of a wide-reaching shareholder agreement on changes to RB’s operation, aimed at increasing security and enhancing efficiency in the operation of financial infrastructure in Iceland. It was determined that the Bank’s interests would be better served by selling its holdings in these companies in a closed sale process. The Bank remains a core investor in RB. Other assets were sold in an open sale process.

| Assets sold in 2021 | Number | Total amount |

|---|---|---|

| Residential apartments | 10 | 405,300,000 ISK |

| Building sites | 14 | 706,100,000 ISK |

| Commercial housing | 11 | 773,400,000 ISK |

| Land | 3 | 247,000,000 ISK |

| Building sites for cottages | 59 | 84.070,000 ISK |

| Cottages | 4 | 36,500,000 ISK |

| Other | 144 | 7,768,800 ISK |

| Shares in unlisted companies | 2 | 145,596,864 ISK |

| Vehicles and equipment | 245 | 305,937,139 ISK |

| Total | 492 | 2,711,672,803 ISK |

Assets for sale at year-end 2021

A total of 164 assets appropriated by the Bank were held for sale as at 31 December 2021. Their book value was around ISK 391 million.

At year-end 2021, sale processes for holdings in 11 unlisted companies were on-going. These holdings are variously owned by Landsbankinn or Hömlur fyrirtæki ehf., a subsidiary of the Bank. Information about these holdings have been disclosed on the Bank's website.

| Appropriated assets undergoing sale process at year-end 2021 | |

|---|---|

| Residential apartments | 1 |

| Commercial housing | 4 |

| Building sites for residential apartments and commercial housing | 8 |

| Building sites for cottages | 147 |

| Land | 3 |

| Vehicles and equipment | 1 |

| Total | 164 |

Enhanced measures to prevent money laundering

In 2021, Landsbankinn updated its internal control system for measures against money laundering and terrorist financing. Alongside work on the update, utilisation of data from the Bank's data warehouse was enhanced to increase understanding of possible risks. The updated internal control system and enhanced use of data allows the Bank to maintain even more robust control and defences.

Work on updating customer due diligence continued and, at the end of the year, was complete for 99% of individuals and 96% of legal entities among active customers. The focus has been on simplifying the due diligence process, guided by customer interests.

Assessment of risk from money laundering and terrorist financing in the Bank’s operation was updated. Inherent risk was assessed for all evaluated risk factors before factoring in the Bank’s control and mitigating measures. Of 65 evaluated risk factors, inherent risk was deemed high in 13 cases and significant in 14 cases. Having regard for the Bank’s controls and measures against money laundering and terrorist financing, the outcome of the risk assessment is that for all evaluated risk factors, residual risk is deemed medium or low; in other words, that residual risk is in no cases high or significant.

As ever, we are focused on safeguarding privacy and the secure processing of personal data. The policies, rules and documented processes that combined form the Bank’s data protection governance system were reviewed during the year and amended to enhance the security of customer rights and personal data protection.

Cookies

By clicking "Allow All", you agree to the use of cookies to enhance website functionality, analyse website usage and assist with marketing.

Ensure website functionality

Analyse usage so we can measure and enhance the quality of the website

Used to display personalised ads